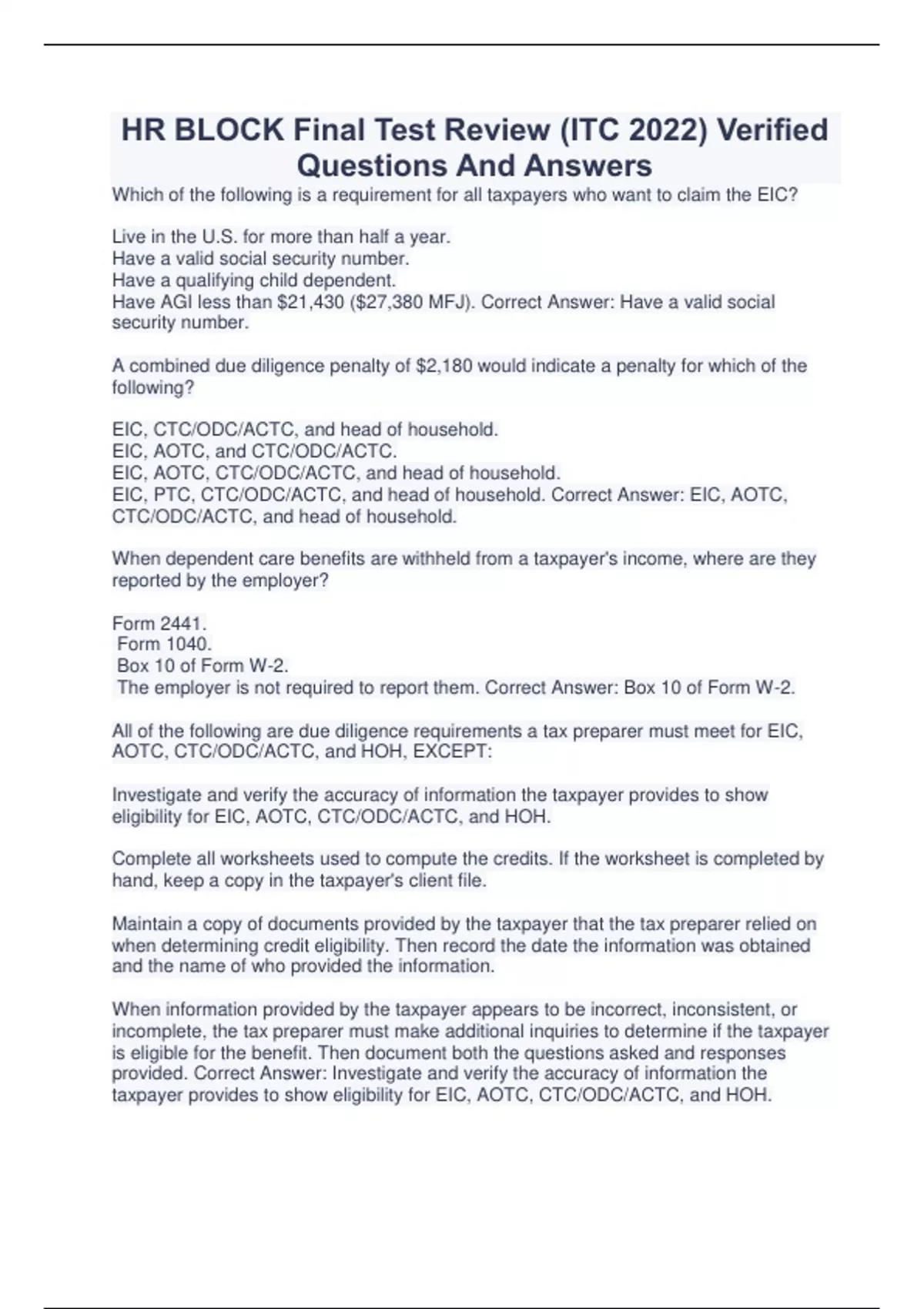

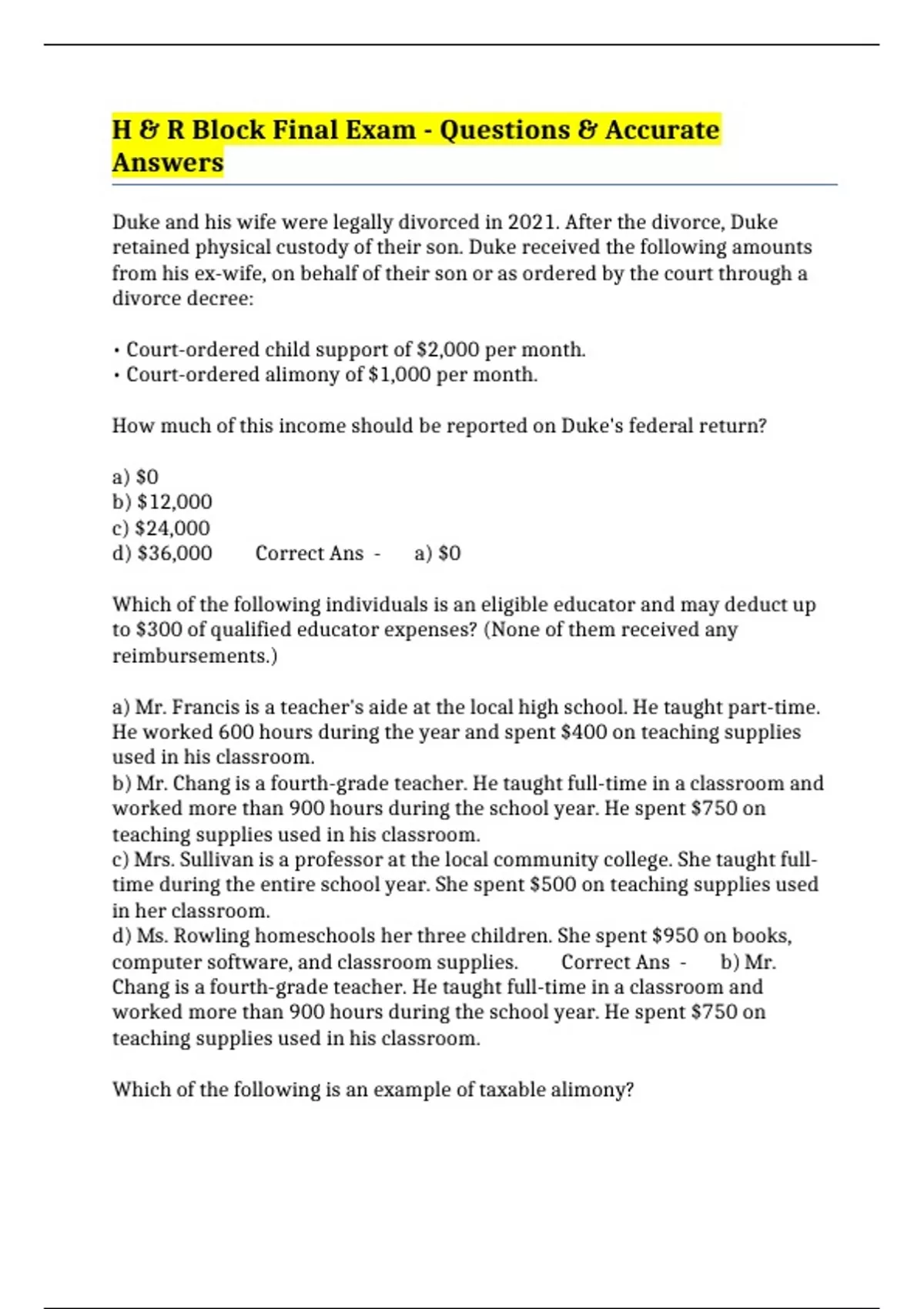

Webhe borrowed $900,000 and purchased a new main home in march of 2020. Soledad will be itemizing his deductions. On what portion of the acquisition debt will interest be deductible on soledad's tax return for 2022? Complete questions & answers (grad... Webwith these case studies, you will be able to identify the where, how, what, and how of the h&r block final exam case study answer. Some of the main characteristics of descriptive case studies include: Web3 days ago · study with quizlet and memorize flashcards containing terms like which of the following is a requirement for all taxpayers who want to claim the eic? Live in the u. s. For more than half a year. Have a valid social security number.

Related Posts

Recent Post

- Csun Portal

- Where Are Cracker Barrels Located

- Wv Metronews

- Newark Ohio Advocate

- Runemetrics

- Ny Bridges Closing

- Seattlescraiglist Jobs

- Zillow Stillwater

- Black Disciples Gang Sign

- Lake County Scanner

- Is Trina And Spencer Leaving Gh

- Home Rentals Vrbo

- Traffic Frederick Md

- Madison County Busted Newspaper

- Show Weekly Options In Tos

Trending Keywords

Recent Search

- Is Jane Still Married To Atz Lee

- Cooper Honig Death Maryland

- Kwhi Brenham

- Petersburg Progress Index Obituary

- Lake Co Scanner

- Salina Ks Obituaries Today

- Rate Your Professor Tcc

- Zillow Virginia

- Tvrj Daily Incarceration

- Kohls Wages

- Zillow Moses Lake Washington

- Costco Part Time Job Hours

- Craigs List Sd

- Weather Underground Philadelphia

- Mugshots Key West