Investing in private equity can be a complex endeavor, particularly when it comes to understanding the intricacies of investor reporting. The ability to effectively communicate performance, risks, and opportunities is essential for fostering trust and transparency between private equity firms and their investors. As the private equity landscape evolves, so too does the importance of streamlined, accurate, and insightful reporting. In this article, we will delve into the various aspects of investor reporting within the realm of private equity, exploring its significance, best practices, and the challenges faced by firms in delivering valuable insights to their stakeholders.

Investor reporting in private equity serves as a crucial tool for aligning interests and expectations between fund managers and their investors. It encompasses a wide range of information, from financial performance metrics to qualitative assessments of portfolio companies. This comprehensive approach not only helps investors make informed decisions but also aids private equity firms in demonstrating their value proposition and strategic vision.

Additionally, as the private equity industry continues to grow, the demands for transparency and accountability are becoming more pronounced. Investors are not only looking for returns but also for a deeper understanding of how their capital is being utilized and the potential risks involved. This article will examine the key components of investor reporting in private equity, addressing common questions and concerns that arise in this complex field.

What is Investor Reporting in Private Equity?

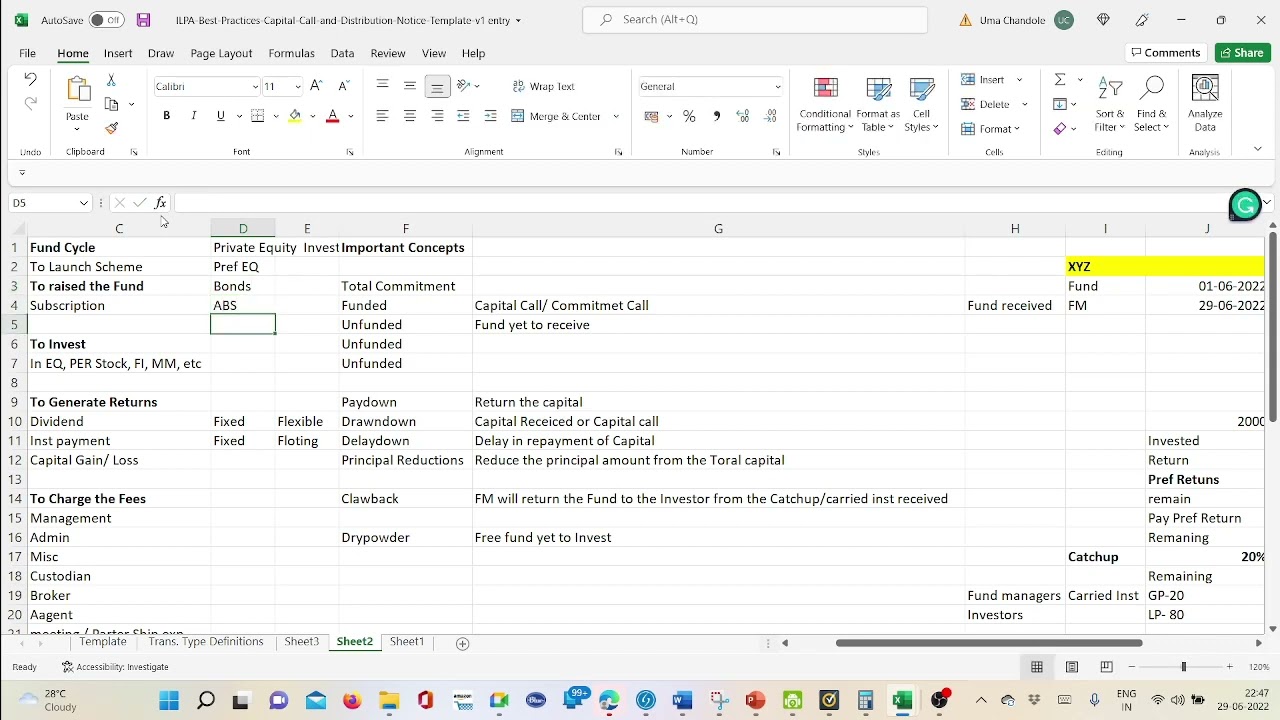

Investor reporting in private equity refers to the systematic process of communicating essential information about a private equity fund's performance, strategy, and overall health to its investors. This reporting typically includes:

- Performance metrics such as internal rate of return (IRR), multiple on invested capital (MOIC), and cash flow analysis.

- Portfolio company updates, including operational performance, market developments, and growth prospects.

- Market commentary and analysis to contextualize fund performance within the broader economic landscape.

- Compliance and regulatory updates relevant to the fund and its investments.

Why is Investor Reporting Critical in Private Equity?

Effective investor reporting is critical for several reasons:

- Transparency: It fosters trust between fund managers and investors, ensuring that all parties are on the same page regarding performance and expectations.

- Informed Decision Making: Investors rely on accurate reporting to make informed decisions about future investments and capital allocations.

- Risk Management: Comprehensive reporting allows investors to assess risks associated with their investments, enabling them to better manage their portfolios.

- Regulatory Compliance: Adhering to reporting standards helps firms comply with regulations and avoid potential legal pitfalls.

What Are the Key Components of Investor Reports?

The structure of investor reports can vary, but they generally include several key components that provide a holistic view of fund performance:

- Performance Summary: A concise overview of the fund's performance metrics, including IRR and MOIC.

- Portfolio Company Updates: Detailed insights into the operational status and strategic direction of each portfolio company.

- Market Analysis: Commentary on market trends and how they may impact the fund's performance.

- Future Outlook: Projections regarding the fund's trajectory, potential exits, and new investment opportunities.

How Often Should Investor Reports Be Provided?

The frequency of investor reporting can depend on several factors, including the firm's policies and the preferences of their investors. Common practices include:

- Quarterly Reports: Many private equity firms provide comprehensive reports on a quarterly basis, offering insights into fund performance and portfolio updates.

- Annual Reports: A more detailed annual report may be issued to summarize the fund's overall performance and strategy.

- Ad-hoc Updates: In addition to regular reporting, firms may provide ad-hoc updates in response to significant events or changes in the market.

What Challenges Do Firms Face in Investor Reporting?

While investor reporting is essential, private equity firms often face challenges in delivering high-quality reports:

- Data Collection: Gathering accurate and timely data from portfolio companies can be difficult, particularly if they are in various stages of growth.

- Standardization: Ensuring that reports are consistent and standardized across different funds and portfolio companies can be a logistical challenge.

- Technology Integration: Implementing the necessary technology to streamline reporting processes can require significant investment and training.

How Can Firms Improve Their Investor Reporting?

To enhance their investor reporting capabilities, private equity firms can adopt several best practices:

- Leverage Technology: Utilize reporting software and data analytics tools to streamline the data collection and reporting process.

- Standardize Reporting Formats: Implement standardized reporting templates to ensure consistency and clarity across reports.

- Engage Investors: Actively seek feedback from investors to understand their information needs and preferences.

- Focus on Storytelling: Present data in a narrative format that highlights key insights and trends, making it easier for investors to grasp complex information.

What Role Does Compliance Play in Investor Reporting?

Compliance is a crucial aspect of investor reporting, as private equity firms must adhere to various regulations and industry standards. This includes:

- Ensuring that reports are accurate and not misleading.

- Fulfilling obligations under the Securities and Exchange Commission (SEC) regulations and other governing bodies.

- Maintaining proper records and documentation to support reported performance metrics.

Conclusion: The Future of Investor Reporting in Private Equity

As the private equity landscape continues to evolve, so too will the expectations surrounding investor reporting. Firms that prioritize transparency, accuracy, and investor engagement will likely gain a competitive advantage in attracting and retaining investors. By embracing technology and implementing best practices, private equity firms can enhance their reporting capabilities, ultimately leading to stronger relationships with their investors and improved fund performance.